World class trading features

Order books with top tier liquidity so you can take advantage of every situation

Exchange

Top tier liquidity.

Order books with top tier liquidity, allowing you to easily exchange Bitcoin, Ether, Tether and many more, with minimal slippage. Take advantage of our suite of order types to help take advantage of every situation.

Margin trading

Up to 10x leverage.

Trade with up to 10x leverage with funding from our peer to peer margin funding platform. You can enter an order to borrow the desired amount at the rate and duration of your choice, or you can simply open a position and Bitfinex will take out funding for you at the best available rate at that time.

Margin funding

Earn on fiat & digital assets

Our margin funding market allows you to earn interest on fiat and digital assets by providing funding to traders wanting to trade with leverage. You can offer funding across a wide range of currencies & assets at the rate and duration of your choice.

Derivatives

For advanced traders.

Advanced traders can use the Bitfinex Derivatives to trade perpetual futures, which enable traders to speculate on the future price of an asset. Further Derivative Products are on the way. Bitfinex Derivatives is provided by iFinex Financial Technologies Limited.

Learn more about Bitfinex Derivatives

Advanced features

Scale up your orders

Scaled orders are an algorithmic order type designed to enable you to focus more on strategy instead of spending time manually entering orders. It enables you to automatically create multiple limit orders across a custom price range.

At the same time, you still have full control as you set the diversity and the distribution of the orders.

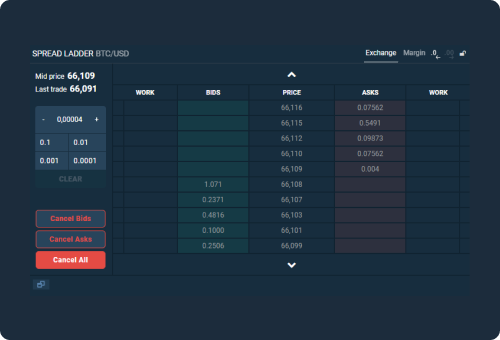

Spread ladder

By taking advantage of Spread ladder orders, you can hedge your position during times of market volatility, enter and exit large positions at an average price range, and manage your risk by spreading entry and exit prices.

Paper trading.

Simulate trading with zero risk and no need to deposit anything. Create multiple paper trading accounts and test all your trading strategies.

Explore all the rich features on our trading platform without any risk in a simulated market experience.

More advanced features