Master

the markets

with powerful trading tools

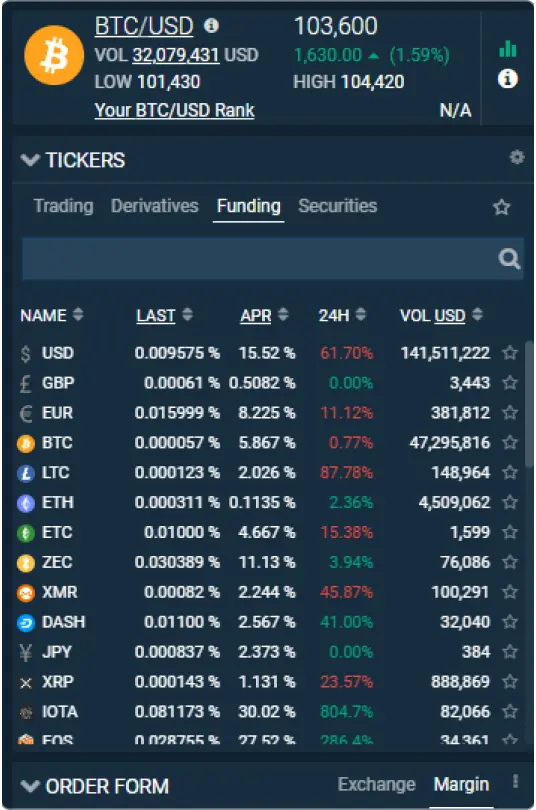

Bitfinex puts you in control with world-class trading features, deep liquidity, and advanced strategies designed to help you seize every opportunity. Whether you're trading, investing, or optimising your capital, our platform is built for those who demand precision and performance.

Zero trading fees are live. Maker and taker trading fees are now 0%.

ADVANCED TRADING FEATURES

Master every market move

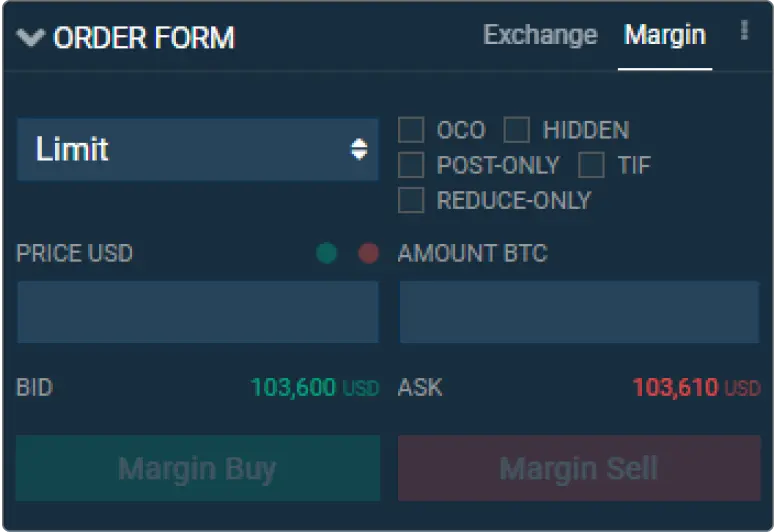

Automate order placement across a price range with Scaled Orders, so you can focus on strategy instead of execution.

Hedge positions, enter or exit large trades at an average price, and optimise risk management during market fluctuations.

Simulate real market conditions, experiment with strategies, and refine your trading edge-all without risking capital.

BUILT FOR PROFESSIONALS,

ENGINEERED TO BE IN CONTROL

Institutional-Grade Connectivity

Gain ultra-fast access to our digital asset gateway with low latency, co-location services, and direct market connectivity.

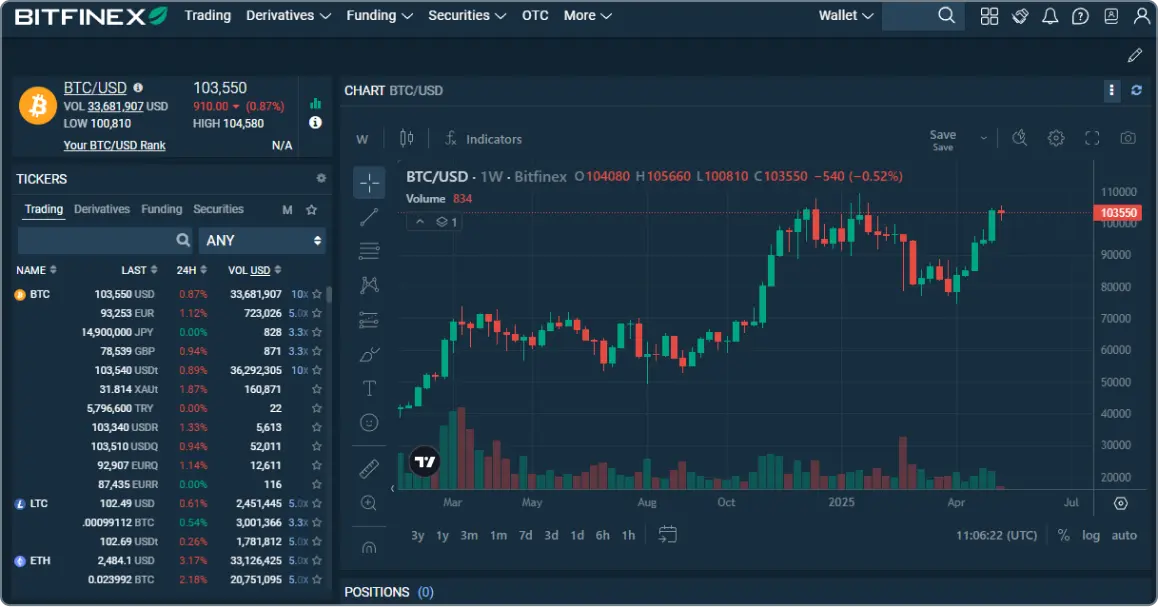

Advanced Charting Tools

Trade visually with powerful charting tools that let you modify orders, track positions, and annotate your strategy in real time.

Corporate Accounts

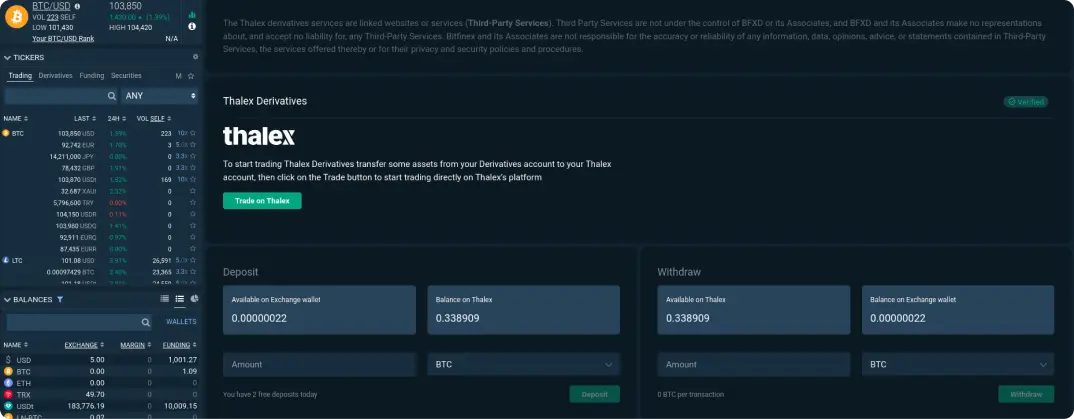

& API Integration

Unlock exclusive corporate solutions with sub-accounts, priority verification, and dedicated support. Integrate seamlessly with our REST and Websocket APIs to build your own trading solutions.

Trade with Zero Fees

Maker and taker trading fees are now 0%, so your cost base is simpler and your execution is cleaner. Scale, rebalance, and manage exposure without trading fees reducing net results.

Bitfinex is more than a trading platform-it's a gateway to financial freedom.

MASTER YOUR UNIVERSE

Trade with confidence